springfield mo sales tax rate 2021

The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. Local tax rates in Missouri range from 0 to 5875 making the sales tax range in Missouri 4225 to 101.

Age 65 And Over Tax Exemptions For Missouri Agexmmo29a647ncen Fred St Louis Fed

The latest sales tax rates for cities in Missouri MO state.

. 2020 rates included for use while preparing your income tax deduction. The City of Springfields April 2021 sales tax revenues from the Missouri Department of Revenue came in at 3887612. 2021 Best Places To Live In The Springfield Mo Area - Niche.

072021 - 092021 - PDF. Enter your street address and city or zip code to view the sales and use tax rate information for your address. This includes the rates on the state county city and special levels.

Find Sales and Use Tax Rates. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. The base sales tax rate is 81.

The minimum combined 2022 sales tax rate for Springfield Missouri is. 5 2019 the most recent renewal of the 18-cent Transportation Sales Tax was passed with a 20-year. What is the sales tax rate in Springfield Missouri.

Find your Missouri combined. 102021 - 122021 - PDF. Statewide salesuse tax rates for the period beginning July 2021.

The springfield missouri sales tax rate of 81 applies to the following thirteen zip codes. On a fiscal year-to-date basis through April 2021 actual revenues are. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

18-cent Transportation Sales Tax 2021 - 2041 Approved by Springfield voters on Nov. Statewide salesuse tax rates for the period beginning October 2021. The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent Conservation 0125 percent Education.

Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax. SalesUse Tax Rate Tables. 15 lower than the maximum sales tax in MO.

The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax. Rates include state county and city taxes. 1028 rows 2022 List of Missouri Local Sales Tax Rates.

Average Sales Tax With Local. The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. Sales Tax Revenue FY 2021 Budget FY20 Actual FY21 Actual 542 781 Year-to-date sales tax revenues are up 781 compared to budget through May 2021.

Indicates required field. The City of Springelds May. Springfield is located within Greene.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. The base state sales tax rate in Missouri is 423. Counties and cities can charge an additional local sales tax of up to 5125 for a.

This is the total of state county and city sales tax rates. 2022 SalesUse Tax Rate Tables. Sales Tax Revenue FY 2021 Budget FY20 Actual FY21 Actual 495 656 Year-to-date sales tax revenues are up 656 compared to budget through March 2021 The City of Springelds.

What is the sales tax rate in the City of Springfield. Integrate Vertex seamlessly to the systems you already use. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

The average cumulative sales tax rate in Springfield Missouri is 782.

Taxes Springfield Regional Economic Partnership

Missouri Sales Tax Guide For Businesses

Michigan Sales Tax Guide For Businesses

Missouri Income Tax Rate And Brackets H R Block

Craft Fairs And Sales Tax A State By State Guide

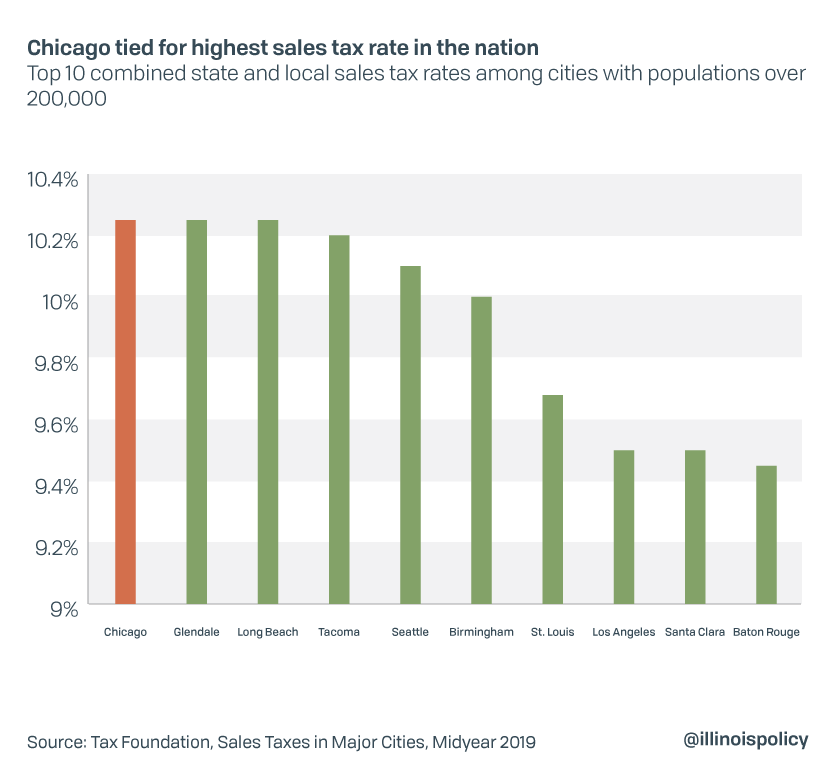

New Chicago Taxes Sale Online 60 Off Www Visitmontanejos Com

Missouri Sales Tax Small Business Guide Truic

Sales Tax On Grocery Items Taxjar

States Are Imposing A Netflix And Spotify Tax To Raise Money

Nebraska Sales Tax Rates By City County 2022

Use Tax Web Page City Of Columbia Missouri

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

Missouri Sales Tax Rates By City County 2022

Harris County Tx Property Tax Calculator Smartasset